As an online merchant, you like to evade a conflict with a customer. Whenever a customer files a dispute or chargeback, with their credit card network rather than functioning with you to fix the problem, it could charge you more than the funds from the payment.

To save your business from experiencing regular chargebacks and the costs connected with them. So, it is essential to know how these disputes function and what you can accomplish to deny them.

What is a chargeback?

A chargeback, also known as a payment dispute, is a lapse of funds after a customer has subjected a dispute on a credit or debit card transaction with their bank. The fair credit billing act of 1974 made chargebacks a customer security system against fraudulent prices.

After a customer files a dispute with their credit card business, the chargeback procedure initiates and the dispute transaction funds are unavailable before fixing the problem. However, if the final decision is in the favor of the customer, they don’t need to pay the cost. Yet, if the decision is in your favor, the conflicted funds go to you.

What is the procedure for a chargeback?

The chargeback procedure can differ relying on whom you prefer for payment processing. Yet, here is what you can actually predict:

- The payment for purchasing something is processed

A purchase is conducted from your business preferring a credit or debit card. The payment is processed, and you take the funds into your business account.

- The customer disputes the price

The customer sees the payment and files a dispute with the bank that provided their card, also known as issuing bank.

- The procedure of chargeback initiates

The issuing bank delivers the customer a brief credit for the payment and then begins the chargeback procedure by connecting with your payment service provider.

- Funds are withdrawn from the merchant’s account

When your payment service provider understands the chargeback, you will be informed and the disputed money will normally be deducted from your business account until the dispute is fixed.

- Merchants can deny the chargeback

You are provided with the chance to deliver documents to deny the chargeback. If you don’t reply to the chargeback information, the issuing bank will normally give the dispute to the cardholder.

- Issuing bank decides the chargeback

If you deliver documents to deny the chargeback, the issuing bank will assess the proof and make a judgment. But if the bank regulates in your favor, the customer has to pay and the funds are transferred back to you.

- Chance of negotiation

If you or your customer is unsatisfied with the decision, you can go to a negotiation procedure where the chargeback dispute is taken to the connected credit card network (such as Visa, MasterCard, or AmericanExpress) for final judgment.

Causes for chargebacks

It is essential to know why customers dispute chargebacks and what you can accomplish to control and conflict with them. Basically, chargebacks come into two categories:

Correct use of the chargeback procedure

The chargeback procedure delivers customers a method to dispute payments on their credit card statement by moving via their bank rather than the merchant. Generally, customers have 60 days from the time they take their bill to inform their credit card business that they are conflicting a payment. However, verified credit card disputes with merchants basically come into these three regions:

- Unapproved payments

These are fraudulent costs that may be the outcome of the loss or robbery of a customer’s physical card or the locking of their card details by another method. - Billing Issues

These may involve wrong purchase details and funds, failure to deliver credit for refunds, costs for goods the customer did not take, and assessments for products that were not available as approved. - Unfixed customer objections

If a customer is not fine with a merchant’s revert they have an issue about quality or another matter, they may conflict with the cost

Incorrect use of the chargeback procedure

There are circumstances where a customer may file a chargeback for various causes that are not actually legal. Incorrect usage of the chargeback procedure, whether accidentally or intentionally, basically, you can call a “friendly fraud.” However, these are some instances of customers incorrectly using the chargebacks:

- Evading the recovery procedure

- Not identifying the transaction

- Asserting a legal buy is fraud

How to control excessive chargebacks?

There are tricks you can apply to reduce the volume of chargebacks your business experiences:

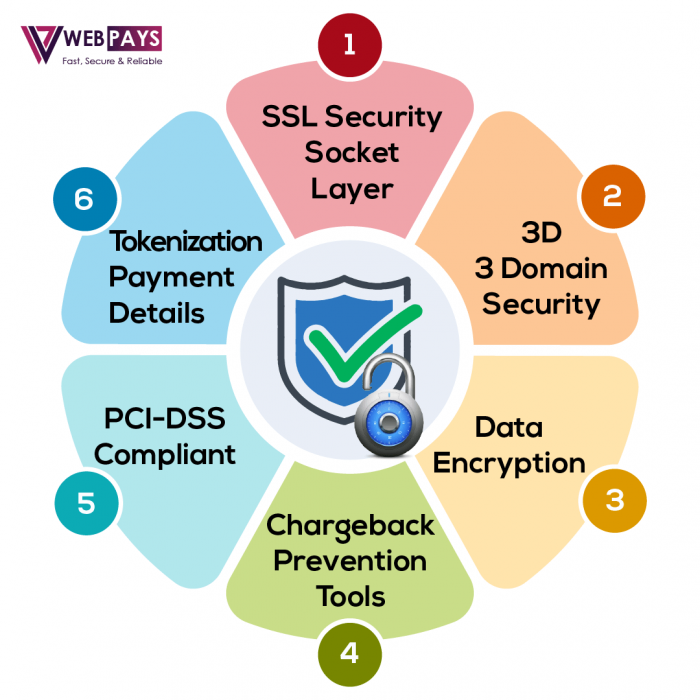

Obey credit card approval policies and best measures. And you can also reduce chargebacks by obeying credit card policies and PCI-DSS-compliant standards. These are some common practices that can also assist you to decrease chargebacks volume:

- Prefer a secure and reliable point-of-sale, or POS, system, and payment processing platform for your online business’s website.

- Always opt for a POS system that is EMV compliant.

- Don’t permit a chip card to be swiped to evade being exposed for a payment conflict.

- Need a customer’s ID and verification for magnetic-strip-only credit cards.

- Always check that the customer submits their PIN or signs a permit for debit card transactions.

- Require customers to deliver the expiration date, sort of card, and CVV code for online or mobile payments.

- Instruct your workers on the right track to process credit card payments.

- Provide payment receipts to the customers.

- Prefer the fraud prevention features and technology delivered by your payment service provider

Conclusion

eCommerce technology is continuously developing and new chargeback risks rise day by day. An efficient chargeback management technology must be adjustable to recognize new updates and strategies, balance new strategies, and adjust on the fly to a diverting environment.

No one can understand this concept better than the payment expert team at WebPays. And that implies we deliver the best and most secure chargeback management features with our payment processing platforms. Our clear, end-to-end solutions function beyond the security of revenue recovery and future development.

So, if you are looking for an online payment processing platform for your business’s website with top-level security and chargeback prevention features. You can also prefer WebPays and acquire the best, most secure, and most reliable payment processing solutions. We deliver the best international merchant account solutions with multiple advanced security features and assist in expanding online businesses globally.