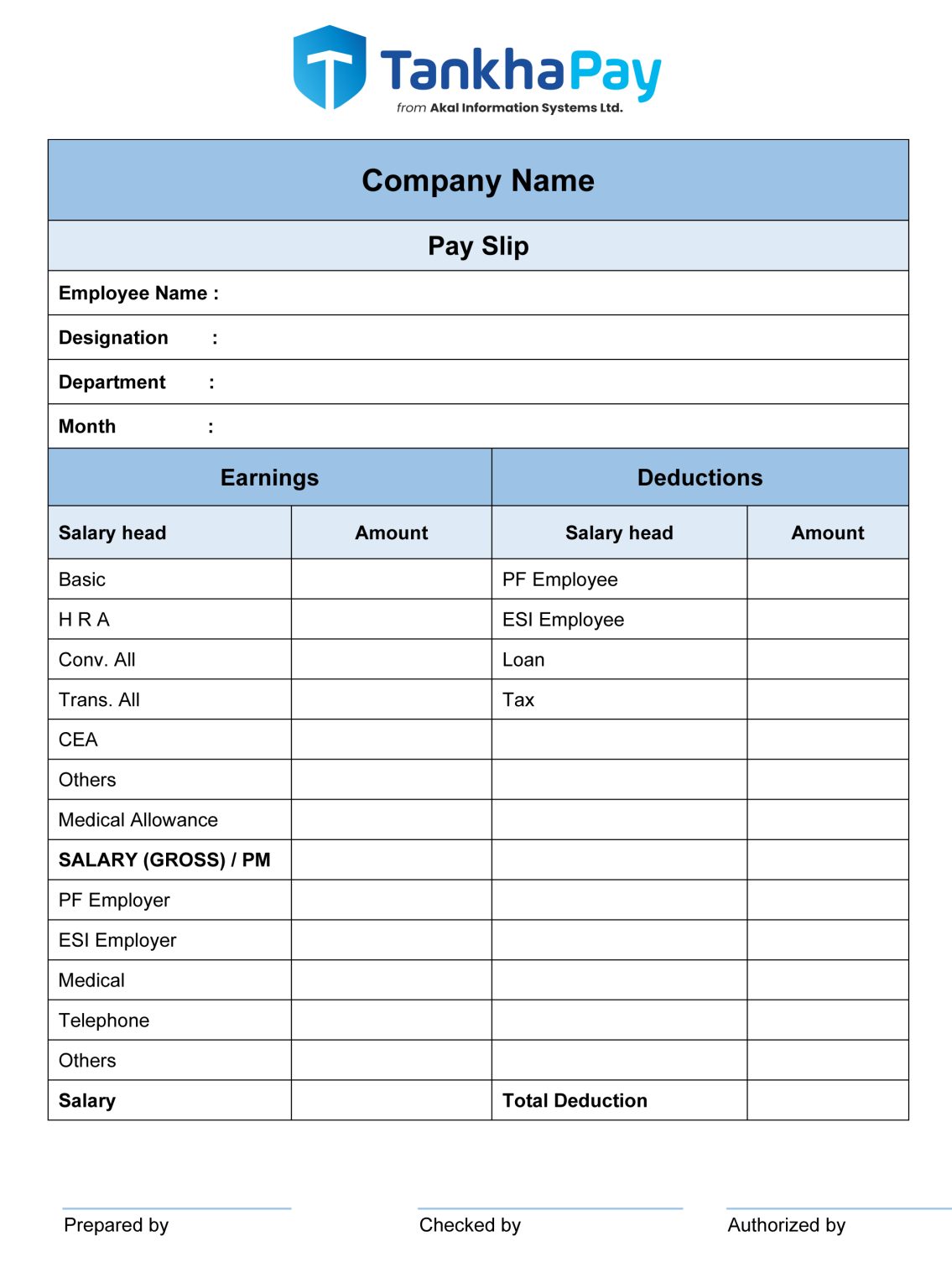

Employers usually provide employees with a monthly pay slip detailing their earnings and deductions for a specific pay period. This document is very important as it lists the employee's base salary, various allowances (rent subsidy, transport subsidy, etc.), bonus, overtime, etc.In addition, deductions, any applicable taxes, contributions to provident fund, business tax and other relevant deductions are calculated. It is important for both employers and employees to understand the intricacies of payroll to ensure clarity about pay, benefits and responsibilities.

What is a Salary Slip?

A salary pay slip is a document that every salaried individual receives from his or her employer, but not many are aware of its importance. Do common terms like gross salary, tax deductions, and reimbursements often leave you confused? Worry not! Here, we cover the crucial aspects related to a salary slip.

Why is a Salary Slip Important?

The issuance of a Salary Slip Format holds significance as it serves as confirmation of the employee's remuneration within the ABC organization. Beyond serving as evidence of income, Payroll plays an important role in facilitating the process of obtaining a bank loan.

Many multinational corporations (MNCs) have stringent requirements regarding the content of salary slips. It is therefore incumbent upon every employee to verify that their payslip contains all essential information.

- Proves your employment status

- Helps in tax planning

- Helps in salary negotiation

- Simplifies the borrowing process, and much more

Difference Between CTC and in-hand salary

- CTC - The Cost to Company (CTC) is the total expense incurred by a company for employing an individual. It encompasses various components such as House Rent Allowance (HRA), Conveyance Allowance (CA), medical expenses, gratuity, Employee Provident Fund (EPF), and other allowances or benefits. CTC reflects the employer’s total financial commitment towards hiring and retaining an employee and helps employees assess the total value of their employment package.

In-Hand Salary - Gross salary is the total income an employee earns before any deductions, such as gratuity and Provident Fund (PF). It isn't typically shown on the payslip but is mentioned in the offer letter. The in-hand salary is the actual amount received after all taxes and deductions have been applied, which is always lower than the Cost to Company (CTC). Understanding the differences between these components helps employees comprehend their earnings and manage their finances better. Examples and illustrations can further explain these distinctions.

Things to Remember about Salary Slip

- The salary slips look great, but the payroll team has to put in a lot of effort to calculate the net pay amount.

- In today’s world, there are many automated payroll management software options in India that provide customizable payslip templates. All the complicated calculations are automated in such software.

- You can personalize the payslip templates according to your organization’s requirements.

- TDS calculations can be complicated. The automated software always stays updated on government compliances.

Benefits of Salary Slip

Electronic payment slip (e-payment slip) has many advantages over traditional payment slip. Contribute to the advancement of environmental sustainability by diminishing paper and waste consumption. E-Pay vouchers increase security and reduce the risk of document loss or theft by providing secure online access to payment details.

Proof of Employment: Essential for many financial activities, pay stubs are official documents that prove employment status and income.

Earnings Breakdown: This provides a thorough analysis of an employee's income, taking into account base pay, benefits, and incentives.

Taxes and Deductions: To help employees understand their tax liability, the system breaks down all the deductible amounts such as: Income Tax, Business Tax and Provident Fund (PF).

Loan applications: Helps show financial soundness by providing proof of income when applying for credit cards, loans, or mortgages.

Tax Filing: By offering a thorough record of earnings and deductions for the fiscal year, this service helps individuals prepare and submit their income tax returns.

Financial Planning: By understanding their net take-home salary, employees may effectively manage and plan their financial resources.

Employee Benefits Tracking: By offering benefits like health insurance, paid time off, and retirement contributions, employers let their staff members get a clear picture of their entire compensation package.

Compliance and Legal Evidence: Ensuring compliance with labor regulations and acting as admissible legal evidence in disputes pertaining to wage disbursements are the functions of compliance and legal evidence.e

Transparency and Trust: Promotes openness in the dealings between employers and employees, which fosters mutual trust and understanding regarding compensation.

Some significant advantages of electronic payslips compared to paper ones are:

Cost-effective - Payslips are securely stored within the payroll processing system, allowing employees to autonomously retrieve and print their respective documents. This streamlined approach facilitates a departure from the laborious and costly nature of traditional paperwork for businesses.

A recent study found that 83% of respondents said switching to e-payslips helped them save money.

Environmental-friendly - Manual payslips, constructed with paper and ink, represent an environmental hazard. In contrast, eSlips significantly diminish the reliance on paper and ink. As such, companies committed to environmental sustainability would be well-advised to phase out the use of paper-based payslips.

Safe - With ePay Slip, employers can be assured that their sensitive data remains secure and the risk of unauthorized access is reduced.

Stored in a Single place - Previously, employees were typically required to manually review extensive physical documentation to ascertain details regarding their prior compensation. Fortunately, the implementation of E-payslips has mitigated this cumbersome process. Subsequently, employees can conveniently retrieve their previous payslips by accessing their HR program through a digital platform.

24*7 Accessibility - In contemporary times, most HR and payroll processing systems provide mobile applications, enabling employees to download and review their payslips from any location conveniently.

Frequently Asked Questions

Q.1 What are the components of a payslip?

Ans- A payslip includes the company logo, employee’s details, basic salary, allowances, deductions, and more.

Q.2 Does a start-up require payroll software?

Ans- A firm, regardless of its size or style, must have a payroll system in place. You can use it to automate, maintain, and manage the payroll for your employees. Book demo with “TankhaPay” a software for Streamline Payroll, Attendance, Work Reports, Social Security Benefits, and Statutory Compliances.

Q.3 What should be mentioned in the salary slip?

Ans- A salary slip serves as proof of an employee's employment and should include all the essential details such as salary, allowances, deductions, and more.

Q.4 What is a payroll management system?

Ans- A payroll management system is the process employers use to pay their employees' wages. It also involves fulfilling their obligations to employees, complying with the law, and maintaining accurate financial records.