Financial management is an important part of running any successful business. Keeping track of income, expenses, and investments can be a time-consuming task. Thankfully, there are now a variety of software programs available that make the process easier - and more efficient. In this blog post, we'll take a look at some of the benefits of using financial management software.

What is a financial management system?

A financial management system is a tool to help people manage their money in an organized and effective manner. Financial management systems provide users with the ability to set up budgets, track income and expenses, provide debt reduction strategies, automate bill payments, plan for retirement, and more.

With a financial management system, users are able to view their current financial status while forecasting potential scenarios of where they're headed. Through its various features, a financial management system can help users get control of their future by assisting them in making smarter decisions about their savings and investments.

Factors to Consider while choosing FMS

When deciding upon a financial management system, there are various aspects to consider in order to ensure it meets the needs of your organisation. Firstly, you should make sure the system has safety and security features to protect company information and data.

Furthermore, look for user-friendly features that enable employees within your organisation to quickly and efficiently access financial information. Additionally, evaluate different platform options such as web, cloud or on-premise solutions - selecting the one that most suits specific organisational requirements.

You also need to check compatibility with existing software applications so they can communicate with each other. Finally, ensure it is cost-efficient and offers enough scalability options to be able to expand in line with your business needs. Taking all these points into account will set up your organisation for the best fiscal success possible.

What is the role of finance in management?

The role of finance in management is undeniably important. Whether it's a large public organization or a small private business, the successful operation and growth of any business requires careful management of financial resources.

Financial managers must consistently assess the risks and opportunities that come with various investments and long-term strategies. They also need to ensure accurate accounting and reporting, as well as maintaining the financial performance objectives set out by the company’s owners or executive leaders.

Additionally, financial managers are responsible for helping businesses raise capital in an efficient manner. As such, understanding finance is an essential tool for successful management in any size business setting.

Tips to improve finance management

Learning about the basics of finance management is a great way to start responsible handling of money. It includes understanding financial concepts such as budgeting, saving, debt management and investing. Money management is also about assessing spending habits to determine which purchases offer the best value while staying within a set budget.

Finally, exploring additional sources of income can put one in better control of their finances. By mastering these basic tips, individuals can open up numerous possibilities for greater financial stability without the burden of debt or feeling constantly worried about the future.

Managing finances can be a challenge, but the key is to create good habits that make it easier in the long run. This could include automating payments to set aside important bills; cutting costs on small indulgences like daily coffee runs; and paying off debts starting with smaller ones first.

Tracking expenses can also help enable individuals to better understand their spending habits and identify areas where adjustments can be made. Finally, setting financial goals and having a plan in place for how to achieve them can provide a motivating force in staying on top of money management. By following these tips, one's financial well-being will remain healthy and manageable.

Improved Accuracy & Efficiency

Financial management software can help improve the accuracy and efficiency of your financial operations. When all transactions are tracked in one place, it's much easier to reconcile accounts and spot discrepancies or errors quickly. This type of software can also save time by automating tasks like invoicing or recurring payments. Instead of manually entering data into multiple spreadsheets, you can use the software to generate reports in just a few clicks.

Easier Compliance & Tax Preparation

Another benefit of using financial management software is that it makes compliance with government regulations much easier. With the right software program, you can keep track of employee wages and withholdings for payroll taxes as well as other taxes such as sales tax or value-added tax (VAT). This information can then be used to prepare your taxes quickly and accurately.

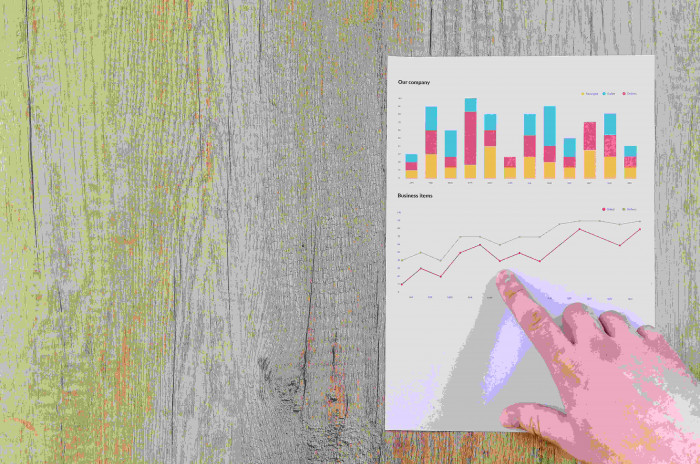

Insightful Analytics & Reporting

Finally, financial management software gives you access to insightful analytics that can help you better understand your finances and make informed decisions about how to grow your business. You can use the data generated by the software to create custom reports that give you an overview of your current financial situation as well as long-term projections for where your business is headed. This information can help you plan strategically for both short-term goals and long-term success.

Conclusion:

Financial management software is an invaluable tool for any business owner who wants to streamline their processes while staying compliant with government regulations and getting insight into their finances. This is very important for from business point of view.

By taking advantage of its features like automated invoicing, tax preparation tools, analytics reporting capabilities, businesses have access to all the information they need in order to make informed decisions about their future growth strategies - right at their fingertips!

If you're looking for ways to improve the efficiency and accuracy of managing your finances, then investing in quality financial management software may be the right choice for you! all community and facility services at one place. RealCube is one of the best financial management software which can help you to manage all your financial expenses. Get free demo and understand how this software work.