Corporate sustainability investors, consultants, and strategists imagine a future where every business has efficient policies governing eco-friendly production methods. Likewise, embracing diversity and financial reporting transparency helps combat legal risks from unethical practices like discrimination and corruption.

This post will discuss the importance of ESG reporting in modern business practices.

What is ESG Reporting?

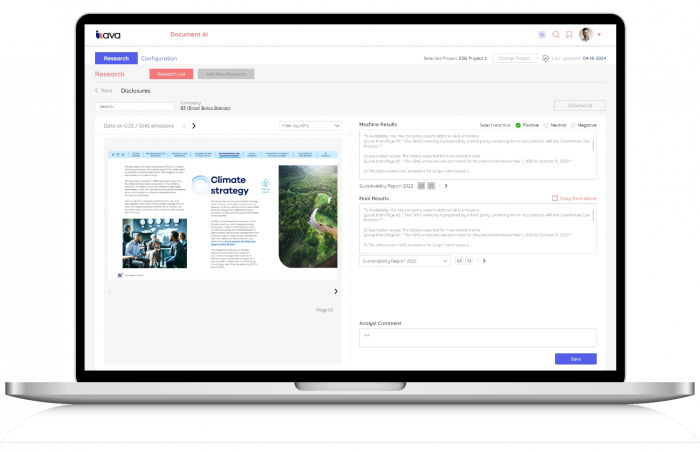

ESG, or environmental, social, and governance, is an investment strategy that assesses business compliance regarding how a company consumes natural resources, handles employee relations, and maintains accounting transparency. Therefore, ESG data management software must capture, validate, and study the relevant sustainability metrics for responsible investors and business leaders.

Using these compliance metrics based on reputed ESG frameworks, investors can predict a brand’s positive or negative impacts on society, nature, and financial systems. Moreover, an ESG report methodically classifies industry-specific metrics into three sections or pillars.

A Brief about the ESG Pillars for Comprehensive Compliance

The environmental pillar involves ESG metrics encompassing how an enterprise develops green technology, avoids deforestation, or reduces plastic usage. It also explores whether a business threatens marine life, emits greenhouse gases, or engages in questionable waste disposal practices.

Diversity and multicultural tolerance are at the core of the social considerations in ESG reporting. Furthermore, averting workplace hazards and empowering professionals from underserved communities demonstrate a company’s commitment to affirmative action policies.

Integral to ESG document tracking, governance helps determine whether an organization has employed adequate financial integrity and cybersecurity measures. After all, investors increasingly expect companies worldwide to excel at region-based legal, IT, and disclosure laws for risk mitigation and healthy relations with respective authorities.

The Importance of ESG Reporting in Modern Business Practices

1| Making Supply Chains More Resilient

A lack of universal trade standardization and flawed risk analytics will expose your supply chains to legal, financial, and environmental threats. However, ESG reports find insights crucial to overcoming those challenges. The governance metrics in sustainability compliance audits check which suppliers participate in socio-economically detrimental activities to warn you.

Using data-backed recommendations in ESG reporting, companies can decide whether to train their suppliers on best practices. Alternatively, leaders can replace suppliers with other resource providers. Consequently, managers will witness increased resilience across the supply chain.

For instance, your suppliers must avoid child labor, reduce pollution risks, and comply with anti-corruption directives. Otherwise, their unethical practices will jeopardize your enterprise’s reputation because investors, analysts, authorities, and consumers will learn about them sooner or later.

Enterprises must not enable irresponsible suppliers to thrive by neglecting the United Nations’ sustainable development goals (SDGs). Besides, informed suppliers will upgrade their operations to respond to industry dynamics and stay in business. Impact investors must examine companies’ and suppliers’ ESG reporting scores during due diligence.

2| Strengthening Consumer and Investor Relationships

Individuals want to purchase eco-friendly products, while impact investors want to support sustainable companies. Therefore, corporate strategists must explore roadmaps for aligning a company’s business model with contemporary stakeholder expectations.

Developing ESG-powered business intelligence to estimate dynamic consumer preferences and value systems will benefit corporations. Consider how they can optimize messaging during a new product launch or furnish pitch decks to secure better investor support.

Similarly, using practical and valid sustainability metrics for marketing materials can significantly increase brand awareness and trustworthiness among consumers sharing the vision for a sustainable future.

On the other hand, several governments have directed companies to adopt consistent financial self-disclosure formats. Since ESG reporting incorporates sustainability accounting guidelines, developing the disclosure documentation for investor communications becomes more manageable.

3| Boosting Efficiency, Team Coordination, and Creativity

Discriminatory work environments will reduce a company’s employee retention. So, leaders must evaluate social inclusivity and employee safety compliance to support workers and inspire energetic, creative, and goal-oriented attitudes.

Similarly, green technology integrations streamline what your team needs to do to reduce energy usage. Governance considerations in finance also prevent accounting inconsistencies and offer honest overviews of an organization’s quarterly progress.

These improvements also help brands communicate many future-centric ideas, address stakeholder grievances, and find new ideas for SDGs.

Consider creativity-demanding cases like green buildings or recyclable packaging innovations. The former saves costs while decreasing your offices’ carbon footprint. Meanwhile, the latter assists in preventing microplastic wastes from entering animals’ bodies or polluting water resources, air, and soil.

Businesses must encourage in-house teams and collaborate with independent domain experts to brainstorm more methods to enhance compliance. Instead of capturing required data from scratch, they can leverage ESG reporting insights for faster idea discovery.

Challenges in ESG Reporting across Modern Business Practices

An ESG report varies based on the stakeholder who requests it. For example, ethical investors will utilize it to screen stocks or companies according to the related sustainability accounting compliance ratings. However, a firm might use ESG insights for compliance risk predictions and problem-solving to increase long-term resilience or competitiveness. It might revise business models or adopt more eco-centric production technologies.

The United Nations member countries have also crafted overlapping policies to encourage businesses and investors to embrace green technology. While they want to mitigate carbon risks and celebrate human rights, too many rules increase confusion among corporate stakeholders. Unified ESG frameworks are crucial for sustainable development goals, but ambiguity between identical yet different policies will lead to delayed implementation.

Independent compliance inspectors conduct sustainability audits on companies with the help of public information and their corporate intelligence networks. Similarly, journalists, academics, scientists, activists, and governments rightfully hold problematic companies responsible for unethical or illegal activities. Nevertheless, poor data quality, biased media coverage, and politically motivated exploitation of ESG metrics can increase controversy risks.

Conclusion

Regulatory bodies and fund managers recognize the rising importance of ESG reporting in modern business practices. It helps promote sustainable development values and address legacy issues to ensure socio-economic harmony worldwide.

For instance, privately sponsored research and development (R&D) into renewable energy resources has attracted investors in many markets.

Consumer associations have also voiced their apprehensions whenever a brand fails to comply with SDGs’ sustainable, inclusive, and transparent vision.

Therefore, leveraging statistical and computer-aided compliance models has become mainstream across business development strategies. As its importance grows with each passing day, leaders must find experienced domain specialists skilled in holistic ESG reporting and work toward achieving UN Vision 2030 milestones.